The Truth about the 1% Sales Tax

It’s Not What You Think

In 2007, the Illinois County School Facility Occupation Tax (CSFT) was passed into law. It “allows elected school boards representing a majority of the county’s student population to place a sales tax hike referendum of up to 1 percent on the ballot.” Proponents of the tax claim that raising the sales tax allows cities to lower property taxes, therefore transferring the tax burden of funding the schools from the county’s residents to shoppers from outside the county. However, there’s no guarantee this will happen—to the contrary, after Champaign County passed a similar tax hike in 2009, school districts saw an overall increase in property taxes of 22.9% within 5 years.

While Effingham County residents who advocate for this tax hike may have the schools’ best interests at heart, the driving force behind the sales tax almost certainly does not. Multi-billion dollar corporations are regularly promoting the tax increase to school boards across the state, all in the hopes of scoring lucrative business contracts once the tax increase is implemented. Stifel, an out-of-state “diversified global wealth management and investment banking company,” was involved in 12 of the 14 sales tax referendums passed in 2014. Follow the money!

Facts about the 1% Sales Tax

- This is a permanent tax, it does not sunset.

- The money can only be used for “school facility purposes,” which does not include salaries, supplies, books, buses, or other operating expenses.

- Effingham County has voted down this tax 3 times already.

- The tax affects online purchases, construction, sales, landscaping, pools, clothing, shoes, box stores, furniture, pets, restaurants, fuel, and more!

There is little to no oversight on how these taxes are used or their effectiveness

- No research has been done on whether the tax has helped the counties where it was implemented.

- No research has been done on how much of the money generated from the sales tax actually comes from out-of-county residents.

- No research has been done on how many districts have actually lowered property taxes after implementing the sales tax.

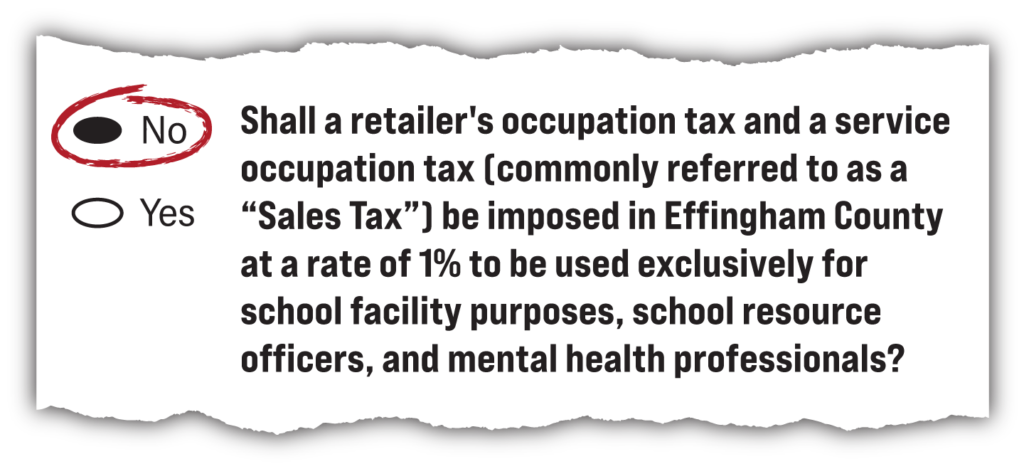

Vote “No” on the 1% Sales Tax on November 5!

Additional Resources

Frequently Asked Questions County School Facilities Sales Tax April 3, 2024

Don’t Be Fooled by ‘Penny for Schools’ Tax

Kankakee County Superintendents Behaving Badly

Meet the Company Pushing Sales-Tax Hikes Across Illinois

Springfield Shopping Gets Pricier After Voters OK School Sales Tax

Collinsville, Granite City Sales Taxes Would Rival Chicago’s Under Tax Hike Referendum

Champaign County Breaks Promise on Sales-Tax Hike

Will County Shoppers Would Pay Among Nation’s Highest Sales Taxes Under Referendum Proposal

Alton Voters to Decide on Sales Tax Hike at the Ballot Box

Madison County Voters Reject Sales Tax Hike at the Ballot Box

Montgomery County Superintendents Consider Sales-Tax Hike

Paid for by the Effingham County Republican Central Committee